Point 72 x Fidelity x AIBC Asset Management Competition 2023

Point 72 x Fidelity x AIBC Competition

Point 72 x Fidelity x AIBC CompetitionPoint 72 x Fidelity x AIBC Asset Management Competition 2023

Overview

Participated in a prestigious global stock pitch competition co-organized by Point 72, Fidelity International, and AIBC. The challenge was to analyze and present an investment recommendation for a publicly listed company in the luxury goods sector, which remains a key indicator of consumer confidence and economic health.

Competition Context

The luxury goods market serves as a critical barometer for consumer confidence and economic conditions. Despite economic uncertainties, the sector continues to demonstrate resilience, with brands adapting to changing consumer behaviors through digital transformation and expanded product offerings.

Our Approach

As the lead data scientist in a team of four, I spearheaded the following initiatives:

Data Collection & Analysis

- Gathered comprehensive market data from Bloomberg Terminal

- Conducted in-depth industry and company analysis

- Performed sentiment analysis on market trends and consumer behavior

Quantitative Modeling

- Developed advanced machine learning models using XGBoost for stock price forecasting

- Implemented time-series analysis to identify key market trends

- Created robust financial models to support our investment thesis

Investment Recommendation

- Delivered a compelling long/short recommendation

- Supported our thesis with both qualitative and quantitative analysis

- Addressed potential risks and catalysts

Deliverables

Comprehensive Pitch Deck

- Company and industry overview

- Stock price history and key events

- Investment thesis and recommendation

- Key drivers and supporting analysis

- Fair value estimates using DCF and comparable companies analysis

- Risk assessment and potential catalysts

Financial Models

- Discounted Cash Flow (DCF) analysis

- Comparable companies analysis

- Sensitivity analysis

Supporting Documentation

- Detailed research notes

- Data sources and methodology

- Supporting charts and visualizations

Achievement

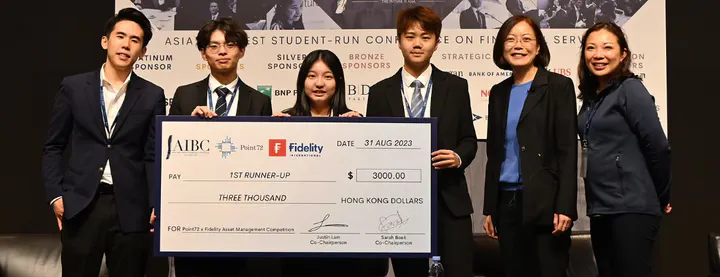

- 1st Runner-up among 300 shortlisted candidates from over 2,000 global applicants

- Recognition for innovative use of machine learning in financial analysis

- Featured in Neural Warrior’s interview with Datalab founder Vik Parachuri

Technical Implementation

- Data Sources: Bloomberg Terminal, company filings, market data

- Technologies: Python, XGBoost, Pandas, NumPy, Scikit-learn

- Analysis: Sentiment analysis, time-series forecasting, financial modeling

Key Learnings

- Gained hands-on experience in institutional-grade investment analysis

- Enhanced skills in financial modeling and machine learning applications in finance

- Developed expertise in presenting complex financial concepts to expert panels

Next Steps

- Explore opportunities to apply similar analytical frameworks to other market sectors

- Continue refining machine learning models for improved prediction accuracy

- Share insights with the broader investment community through publications and presentations