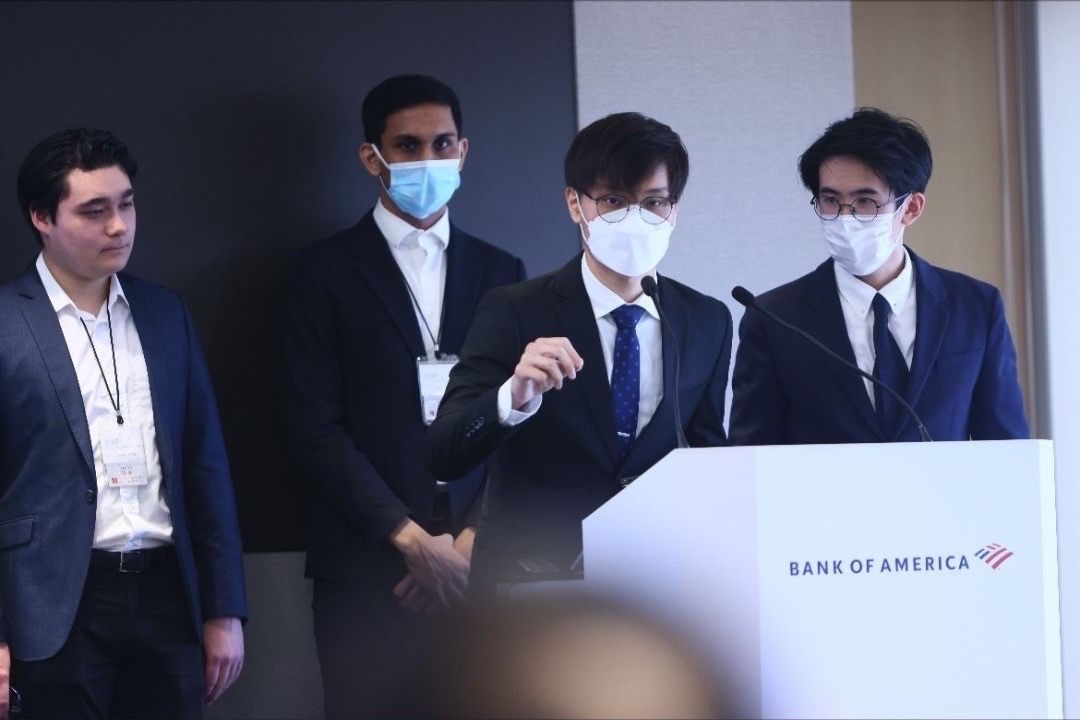

2nd Runner up - Business Administration Paper - Bank of America

Bank of America Business Administration

Bank of America Business AdministrationGreen Business Administration Paper - Bank of America Business Administration

As a prominent competition cohosted by with Hong Kong Federation of Business Students and Bank of America focused on developing business frameworks for environmental, social, and governance (ESG). The initiative aimed to create practical business plan to integrate climate risk management into institutional busniess model.

In recent years, many companies across the globe have started raising concerns about the environmental problems resulting from the production. Climate-related risks may also affect how the global financial system responds to shocks. Existing industries must adopt intelligent and clean production to minimize environmental impacts, including waste management, material recycling, green buildings, energy efficiency, measurement, reporting and verification (MRV) technologies to enable better greenhouse gas (GHG) emission reduction as well as new technology and initiatives to produce cleaner fuel.

Participants are required to select ONE of the two streams:

i) own start-up idea ii) existing company

Participants are also required to propose a green technology service or a product relevant to the chosen business in their stream. Business in any industry is acceptable. A problem in the existing market or business should be addressed first. Regardless of the stream selected, the market, business model, risk, impact on the business field, customers, or other aspects, are suggested to be analyzed.

Project Overview

As financial markets increasingly recognize the importance of sustainability, this project addressed several critical aspects of green finance:

Green Finance Securities Landscape: Researched the Greater Bay Area’s green finance market, developed business models to facilitate carbon credit investing for retail investors.

ESG ecosystem: Created a closed-loop system involving companies’ environmental practices, retail consumptions, retail investing, social impact, and governance structures.

My Contribution

As project leader, I was responsible for:

- Coordinating research efforts across a multidisciplinary team

- Designed software UI dashboard for prototyping and presentation.

- Presenting findings to Bank of America executives and stakeholders

- Ensuring practical applicability of theoretical models

Outcomes and Impact

The project delivered several valuable outputs:

- A comprehensive framework for integrating climate risk into investment decisions

- A closed-loop system bridging retail to corporate investments benefiting industrial distributors, producers, and exchange platform.

- Strategy recommendations for building green-finance oriented portfolios in the face of climate change

This initiative has positioned Bank of America to better manage climate-related financial risks and capitalize on opportunities in the growing sustainable finance market. The methodologies developed have applications across various financial institutions and investment strategies.

The experience gained through this project has significantly enhanced my expertise in quantitative approaches to sustainable finance and ESG investing.